What is Decentralised Finance (Defi)?

What is Decentralised Finance (DeFi)?

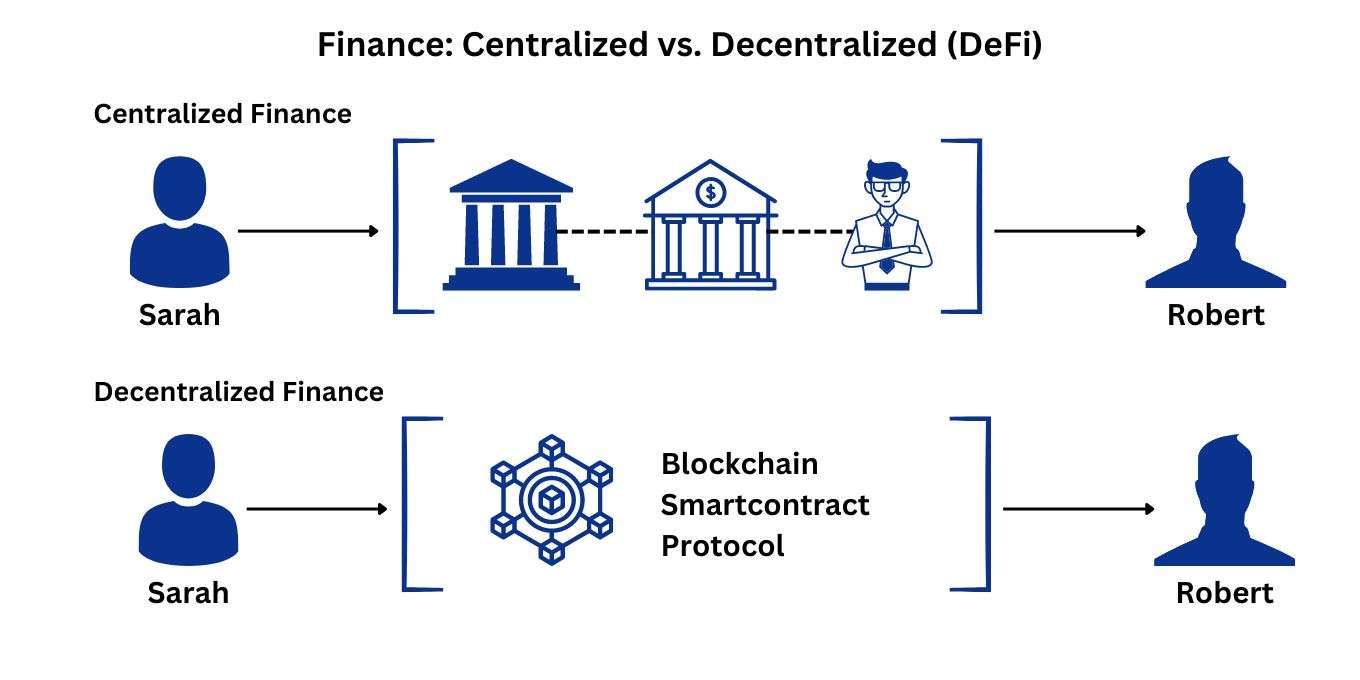

Decentralised Finance, or DeFi, is a revolutionary movement that aims to recreate traditional financial services using blockchain technology. Imagine a financial system that operates without banks, brokers, or any central authority. That's the essence of DeFi – a peer-to-peer ecosystem where individuals can interact directly with each other through smart contracts, opening up a world of possibilities for lending, borrowing, trading, and more, all without intermediaries.

This article will delve into the core principles of DeFi, highlighting its fundamental differences from traditional finance, exploring its origins, and showcasing some practical examples of how it's being used today.

Traditional Finance vs. Decentralised Finance

To truly understand DeFi, it's crucial to contrast it with the traditional financial system (TradFi) we are all familiar with. In TradFi, banks, financial institutions, and governments act as central intermediaries. They control access to financial services, set rules, and facilitate transactions. This centralised control brings a degree of stability and regulation, but it also comes with limitations.

Centralised Finance (TradFi) characteristics:

- Intermediaries: Banks, brokers, and other financial institutions are essential for transactions and services.

- Centralised Control: A single entity or small group of entities has authority over the system.

- Permissioned Access: Users often need to meet specific criteria and undergo KYC processes to access services.

- Lack of Transparency: The inner workings of financial institutions are often opaque.

- Single Points of Failure: The system is vulnerable to failures or attacks on central entities.

Decentralised Finance (DeFi) characteristics:

- No Intermediaries: Transactions and services are facilitated by smart contracts on a blockchain.

- Decentralised Control: Power is distributed among network participants, often through governance tokens.

- Permissionless Access: Anyone with an internet connection and a crypto wallet can access DeFi services.

- Transparency: All transactions on a public blockchain are auditable and transparent.

- Censorship Resistance: No central authority can block or censor transactions.

This fundamental shift from centralised control to decentralised, programmable systems is what makes DeFi so groundbreaking. It opens up financial services to anyone, anywhere, at any time, without the need for traditional gatekeepers.

The Origins of DeFi

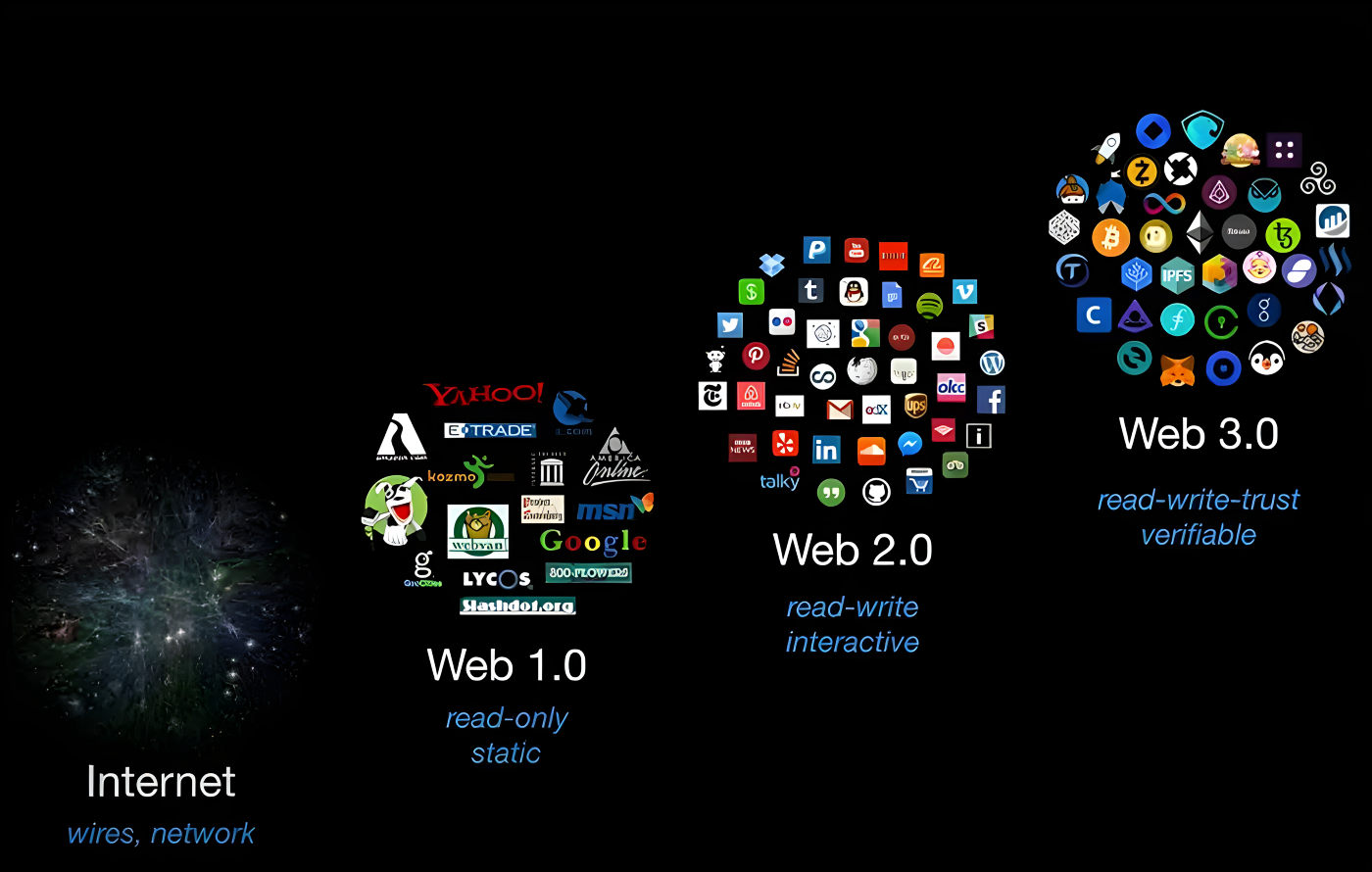

The conceptual roots of DeFi can be traced back to the invention of Bitcoin in 2008. Bitcoin introduced the idea of a decentralised digital currency that could be transferred peer-to-peer without the need for banks. While Bitcoin itself is a digital currency, it laid the groundwork for the idea of a financial system free from central control.

However, the true catalyst for DeFi as we know it was the launch of Ethereum in 2015. Ethereum introduced the concept of "smart contracts" – self-executing contracts with the terms of the agreement directly written into code. These smart contracts are what enable the complex financial applications we see in DeFi today. They allow for automation, transparency, and the elimination of intermediaries in financial transactions.

Early DeFi projects began to emerge around 2017-2018, primarily focused on decentralised exchanges (DEXs) and lending protocols. The "DeFi Summer" of 2020 saw an explosion of innovation and adoption, with new protocols and applications emerging rapidly, attracting significant capital and mainstream attention. This period demonstrated the immense potential of DeFi to disrupt traditional finance and create a more open, accessible, and transparent financial ecosystem.

Key Components of DeFi

DeFi is a complex ecosystem, but it's built upon several key components that work together to create decentralised financial services:

- Blockchains: The foundational layer of DeFi. Most DeFi applications are built on public blockchains like Ethereum, which provide a secure and transparent ledger for transactions and smart contracts.

- Smart Contracts: Self-executing agreements coded onto the blockchain. They automate financial processes, eliminating the need for intermediaries.

- Cryptocurrencies and Stablecoins: Digital assets used within the DeFi ecosystem. Cryptocurrencies like Ethereum (ETH) are used for gas fees and collateral, while stablecoins (e.g., USDT, USDC, DAI) are pegged to fiat currencies, providing price stability.

- Decentralised Applications (DApps): User-facing applications built on top of smart contracts. These are the interfaces through which users interact with DeFi protocols.

- Oracles: Services that connect real-world data (e.g., asset prices) to smart contracts, enabling them to react to external events.

- Liquidity Pools: Pools of cryptocurrency locked in smart contracts that provide liquidity for trading and lending. Users who contribute to liquidity pools earn fees.

These components work in tandem to create a robust and interconnected financial system that operates without central control.

Example Use Cases of DeFi

DeFi has already spawned a wide array of innovative financial services, mimicking and often improving upon traditional offerings. Here are some prominent examples:

- Decentralised Exchanges (DEXs): Platforms like Uniswap and PancakeSwap allow users to trade cryptocurrencies directly with each other without a central order book or intermediary. This reduces fees and enhances transparency.

- Lending and Borrowing Protocols: Protocols like Aave and Compound enable users to lend out their crypto assets to earn interest or borrow crypto by providing collateral. These platforms use smart contracts to automate the lending process, removing the need for banks.

- Stablecoins: Decentralised stablecoins like Dai maintain their peg to fiat currencies through algorithmic mechanisms or collateralisation, offering stability within the volatile crypto market.

- Yield Farming: A strategy where users move their crypto assets between different DeFi protocols to maximise returns, often by providing liquidity or staking tokens.

- Decentralised Insurance: Projects aiming to provide insurance coverage for smart contract bugs, hacks, or other risks within the DeFi ecosystem, using pooled funds and community governance.

- Asset Management: Platforms that allow users to create and manage diversified crypto portfolios, often through automated strategies and community-driven funds.

These examples illustrate the diverse applications of DeFi, demonstrating how it can recreate and enhance financial services in a decentralised and permissionless manner. While still a nascent industry, DeFi holds immense potential to reshape the future of finance.